Business objectives vary, but most businesses share a common objective, growth, except for those who choose to maintain small enterprises for greater hands on management or other personal reasons.

Growth, however, can be elusive where various pitfalls in resource management are not avoided.

1. Not understanding the basis for the business

Businesses are founded to fill a gap in the gap and/or to meet specific needs. These needs regularly change and are also subject to changing environmental factors, including competition, which demands continual readiness to change, an “entrepreneurial mind-set.”

This demands commitment and dedication and a constant eye on the target, usually financial goals, which can only be achieved with a keen eye on the customer and an understanding of their changing needs and/or process changes in the manner to which they fulfil those needs (buyer behaviour).

2. Poor business modelling

Without identifiable revenue streams, an idea is not a business. There need exist a reachable, willing and financially capable market segment (niche) whose directed sales will facilitate the achievement of the financial objectives. Examples of modelling including choosing between a fast food or dine-in for a restaurant. For dine in, you could even consider a membership only restaurant where exists a large exclusive market ready to pay periodic fees, which facilitate more predictable revenue streams than walk in clients.

All these decisions are based on a SWOT analysis, with a club model recommended for locations far away from heavy traffic where it may be difficult to draw in substantial walk in traffic.

3. Not keeping an eye on costs

A rule of thumb is to tie costs to revenues as much as possible (a high variable cost structure) and outsource / lease as much as possible. A retail outfit has no business owning the building in which it operates, as capital is tied in the value of the building. If you start a logistics firm, it is better to hire out independent transporters, while you learn the ropes of the business. Owning own trucks requires maintenance, insurance, security of vehicles, management time e.t.c, taking one away from the core business of growing the businesses. Partnerships are key to growth.

4. Poor cash flows

Many businesses have been brought to their knees because of a mismatch between cash inflows and outflows. In this regard, a “profitable” business can also collapse by what is technically referred to as over-trading. Sooner or later orders cannot be met as resources run out, tied up in receivables.

Various solutions include use of credit, having vendor payment policies to match collections, and adequate bank overdraft facilities (while avoiding “hard core” status on these overdrafts, affecting credit rating and other borrowing rates). Inventories should also be maintained at a minimum with a consideration for a Just In Time (JIT) inventory management system.

5. Not Reinvesting Profits

May result from an underfunded business at initiation with the business owner looking to the business for “survival” or where an entrepreneur is spread too thin with many business ventures, some which drain cash from “cash rich ventures.” Focus and adequate capitalization are key.

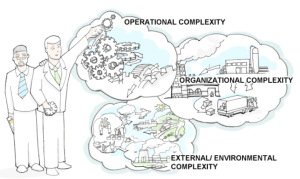

6. Not seeking continuous learning and improvement

The external business environment (Political, Economic, Social and Technological-PEST) is continually changing, examples being; new regulations, changing demographics, declining outdoor activities and greater use of the internet make many business models obsolete. Consequently, there is a continuing need to evaluate the business value chain and identify areas for improvements to reduce costs, or even enhance some processes, that may result in higher costs, but where the potential incremental revenues from the enhancements exceed the additional costs.

Avoiding pitfalls will enhance the business chances to succeed.

Sam Kagiri-01/06/2023 info@benkenya.com

Thank you.

Sam